I posted earlier on Morgan Stanley unmoved by the jobs report: In the preamble to that post I spoke about the data. Repeating it here ’cause it contains what should be useful info: December payroll data from the US was much stronger than expected: The +256,000 headline significantly beat expectations of 160,000. The highest expected […]

Category Archives: Forex News

Mon: N/A Tue: EIA STEO; CBR Policy Announcement; Indian WPI (Dec), US PPI (Dec) Wed: IEA OMR, UK CPI (Dec), EZ Industrial Production (Nov), US CPI (Dec), NY Fed Manufacturing (Jan) Thu: ECB Minutes (Dec), BoK Policy Announcement; Australian Employment (Dec), UK GDP (Nov), EZ Trade Balance (Nov), US Import/Export Prices (Dec), Jobless Claims (w/e […]

UPCOMING EVENTS: Monday: NY Fed Inflation Expectations. Tuesday: US NFIB Small Business Optimism Index, US PPI. Wednesday: UK CPI, US CPI. Thursday: Japan PPI, Australia Employment report, UK GDP, US Retail Sales, US Jobless Claims, US Import Prices, US NAHB Housing Market Index, New Zealand Manufacturing PMI. Friday: China activity data, UK Retail Sales, US […]

AI image The market doesn’t think the Federal Reserve will cut rates twice this year in light of a strong finish to the year for jobs. The unemployment rate fell to 4.1% from 4.2% and the economy added 256K jobs compared to 160K expected. Market pricing now shows that a May rate cut to a […]

The US jobs report came in stronger than expectations and that has led to yields moving sharply higher. The year is up 9.0 basis points they 10-year is up 8.6 basis points. For the EURUSD it fell to a new low going back to November 2022. The low price reached 1.0212. The 61.8% retracement of […]

S&P 500 futures are down 43 points, or 0.7%, ahead of the open. That’s better than I would have thought given the jump in jobs and a rise in 10-year yields to 4.75%, which is the highest since November 2023. The low of the pre-market came on the release but there has been some dip […]

The USDJPY has been trading within a swing area between 157.66 and 158.86. Looking at the daily chart today, the low price came in just below the low of the swing area and 157.62. The high price reached just above the high of the swing area at 158.86. The swing area is wide but traders […]

CL1 Oil is ripping higher today, rising nearly 5% to the best levels since October. WTI crude oil is up $3.60 to $77.49 while Brent has cracked $80. A Reuters report appeared to kick off the move as it says the US will impose sanctions on 180 vessels transporting Russian crude, dozens of traders and […]

The most-interesting Federal Reserve decision of Trump’s Presidency is likely to be June 17, 2026. That is a meeting that contains economic projections and will also be the first meeting chaired by Trump’s FOMC Chairman. He has frequently lamented his choice of Powell, in part because the Fed Chair took a hard line against political […]

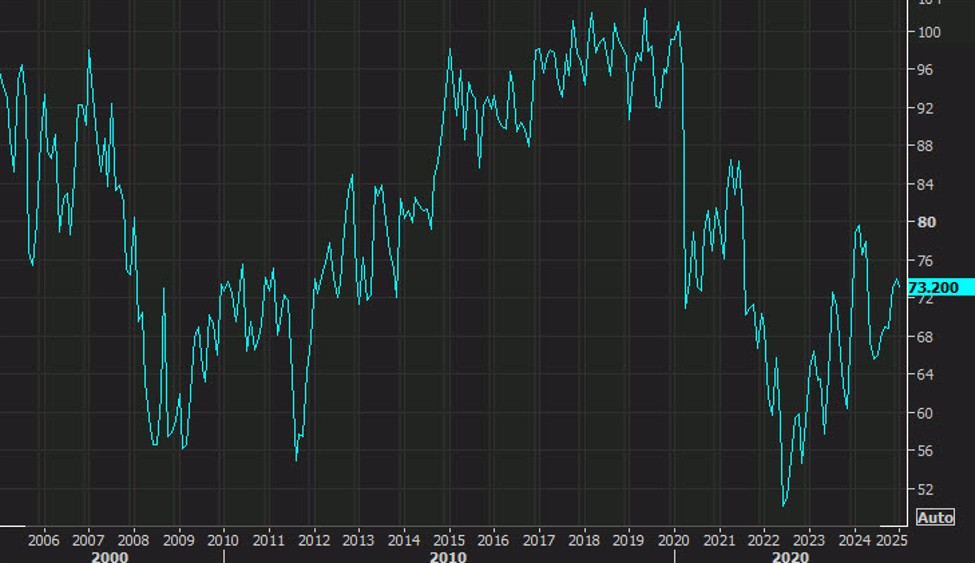

Prior was 74.0 Current conditions 77.9 vs 75.1 prior Expectations 70.2 vs 73.3 prior 1-year inflation 3.3% vs 2.8% prior 5-year inflation 3.3% vs 3.0% prior This is another body blow for stocks, those inflation numbers are a problem though they might reflect expectations about tariffs. This matches the highest since 2008. This is an […]