Prior was +3.2% PPI -0.4% m/m vs +0.2% expected Ex food and energy +3.3% y/y vs +3.6% expected Ex food and energy -0.1% m/m vs +0.3% expected Ex food, energy and trade +3.4% vs +3.5% prior Ex food, energy and trade +0.1% vs +0.4% prior This is some welcome cooling that shows some disinflation is […]

Author Archives: gtiqy

S&P 500 futures are now back up around 1% on the day while 30-year bond yields in the US have eased to around 4.84% currently. On the latter, that’s down from around 4.91% at the high earlier and will allow broader markets to breathe a little easier heading into US trading. China retaliated by increasing […]

ECB is monitoring and ready to use instruments it has if needed to procure price stability. She’s just saying that the central bank stands ready to use all of its instruments in case things go awry. The market is 100% sure of a 25 bps cut at the next week’s meeting and expects at least […]

Akazawa will be meeting with Bessent and Greer for talks, according to the NHK. Japan being one of the closer allies to the US makes this process a bit easier, alongside the fact that they are the ones to approach Trump and his team to talk. But right now, the focus is solely on China […]

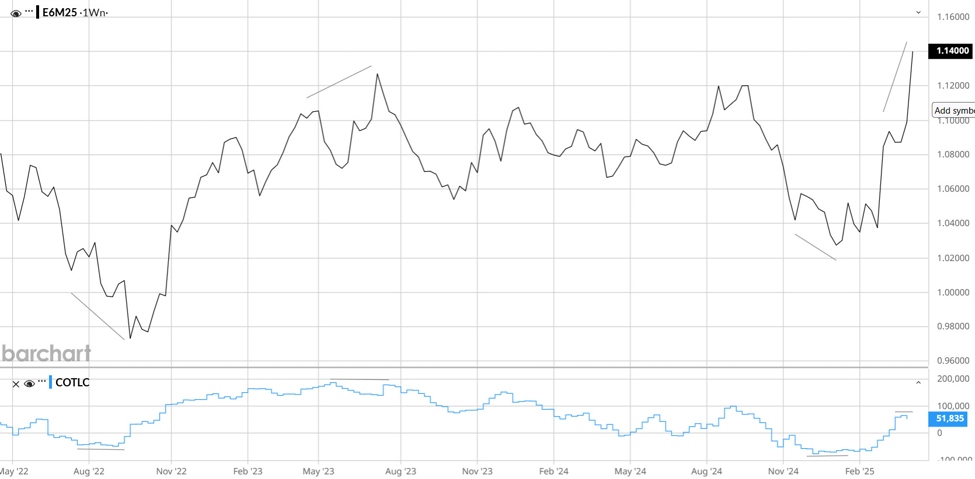

In the FX world, everyone is talking about the US Dollar selloff and there are even talks of the greenback losing its reserve status and what not. Generally, when people get very bearish (or bullish) something, that’s when the market does the opposite. Bloomberg reported that traders are the most bearish on the USD in […]

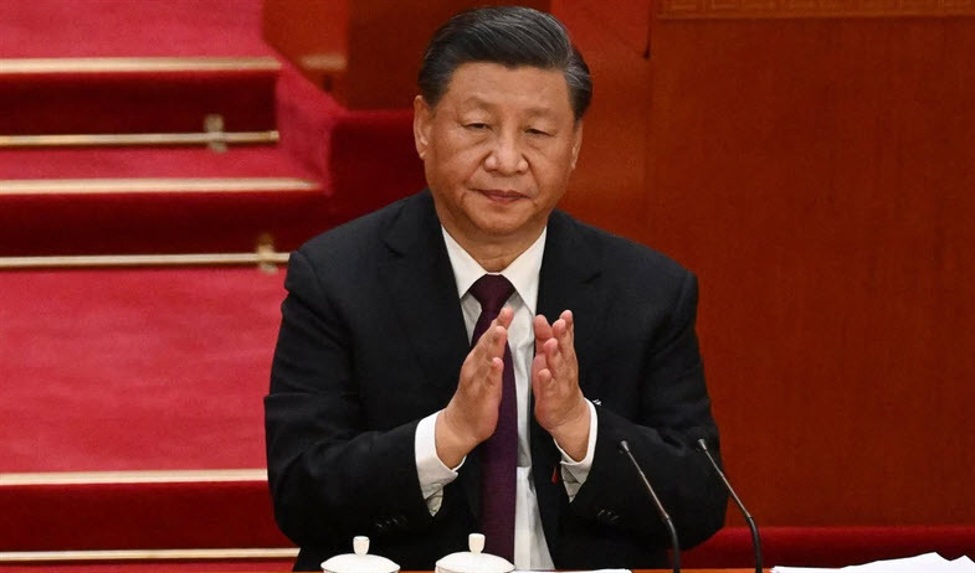

No matter the changes to external environment, China will strengthen its confidence To maintain determination and concentrate on doing its own thing China and Europe should stick to partnership and adhere to open cooperation China and Europe should fulfil international responsibilities, jointly maintain international trade order Both sides should not only safeguard own interests but […]

The situation last week of course was not helped by China announcing 34% retaliatory tariffs against the US here. Ah, just 34%? Good times. 10-year Treasury yields were also sitting at 3.88% then, and now they’re at 4.45%. If anything, it goes to show what a wild one week it has been in markets. S&P […]

Despite a decent 30-year bond auction yesterday, yields are continuing to surge as broader market dislocations are persisting. 30-year yields in the US shot to a high of 4.95% earlier but is still up around 3 bps near 4.90% currently. That follows from the jump overnight in erasing the decline from late Wednesday, when Trump […]

US Commerce Secretary Lutnick with a strange desire/wording for the US economy: Little wonder Lutnick has been demoted: Trump has sidelined some of his advisers – poor performers Lutnick & Navarro on the outer This article was written by Eamonn Sheridan at www.forexlive.com. Source link

This readout via the People’s Bank of China: China’s Xuan Changneng, Deputy Governor of the PBoC, attended the ASEAN+3 Finance and Central Bank Deputies Meeting in Kuala Lumpur. He chaired discussions as China’s co-chair of the 10+3 Finance and Financial Cooperation Mechanism. Key topics included: Impact of US tariffs on global and regional macroeconomics. Strengthening […]