Trump’s latest comments have been met with ‘cave in’ comments, which, if true, is great news for markets: Its very naive to disregard the risk that he flips again in his next set of comments/tweets. Stay nimble out here, trump has lost credibility with markets markets due to his acting on iimpluse, his sudden reversals. […]

Author Archives: gtiqy

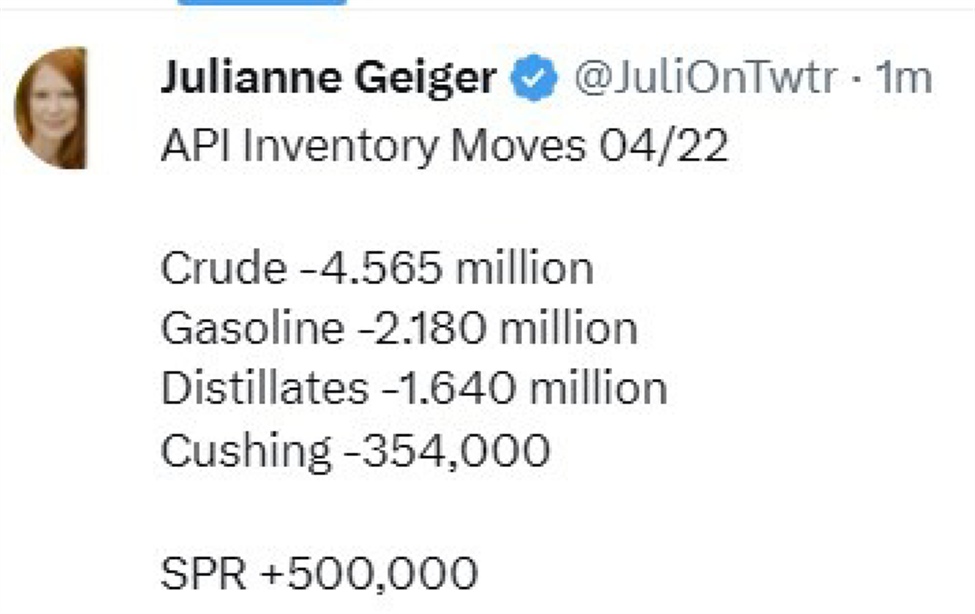

Via oilprice.com: — Expectations I had seen centred on: Headline crude -0.8mn barrels Distillates 0.0mn bbls Gasoline -1.4 mn This data point is from a privately-conducted survey by the American Petroleum Institute (API). It’s a survey of oil storage facilities and companies The official report is due Wednesday morning US time. The two reports are […]

Goldman Sachs maintains a constructive view on GBP/USD, citing UK resilience to US trade shocks and European FX strength. However, they advise caution on Sterling relative to other European currencies due to lingering domestic risks. Key Points: GBP/USD Outlook Positive:Sterling continues to benefit from broad EUR FX strength and its lower vulnerability to US tariffs, […]

Now that Bessent has leaked market moving information, it looks like his team is into damage control. Here’s a thought, Mr Treasury Secretary, how about you stop delivering remarks at private meetings to JPMorgan clients and then there won’t be any confusion? Is that too much to ask? This article was written by Adam Button […]

This Bessent fiasco of inside information is unfolding in slow motion. The latest is from CNBC that reports: Source in the room tells me this is a rough transcript of the comments Treasury Secretary Bessent made yesterday at a closed door event that are moving markets today: “The next steps with China are, no one […]

The US stocks are getting a boost from comments from Treas. Sec Bessent who said that terrible standoff with China is unsustainable, and that he expects the situation to de-escalate. The comments were made within a closed-door investor Summit on Tuesday. The NASDAQ index moved up to 16333.89. The 100 hour moving averages at 16398.11. […]

Trump has been quiet on the tariff front today and with that it’s no surprise that equities have a bid. The S&P 500 has extended its gain to 2% and the gap lower at yesterday’s open is now almost closed. SPX 10 mins It can all change with a tweet so beware. Some people were […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

USDCAD fell during yesterday’s Asia-Pacific session, breaking below a key swing area between 1.38078 and 1.38499. The initial decline reached a low of 1.37808 before rebounding to a session high of 1.3845, near the upper boundary of the previously mentioned swing zone, which dates back to October and November 2024. The price subsequently rotated lower, […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]