Treasury Secretary Janet Yellen fired off a warning shot to Congress today, flagging a critical debt ceiling timeline that could rattle markets in early 2025. Debt ceiling reinstates Jan 2 Default risk window: Jan 14-23 Treasury to deploy ‘extraordinary measures’ if needed The timing adds another layer of complexity to an already heated political environment […]

Author Archives: gtiqy

Closing changes: S&P 500 -1.1% Nasdaq Comp -1.5% DJIA -0.8% Russell 2000 -1.6% Toronto TSX Comp -0.2% On the week: S&P 500 +0.7% Nasdaq Comp +0.8% DJIA +0.4% Russell 2000 +0.1% Toronto TSX Comp +0.8% We get two more days of trading before the scoreboard resets at zero. This article was written by Adam Button […]

The USDJPY moved lower in the US session but after getting within 11 pips of the rising 100 hour MA. THe price has since bounced back to 157.84 currently as the buyers remain in firm control. THe last time the price tested the 100 hour MA was back on December 17 adn Deceember 18 before […]

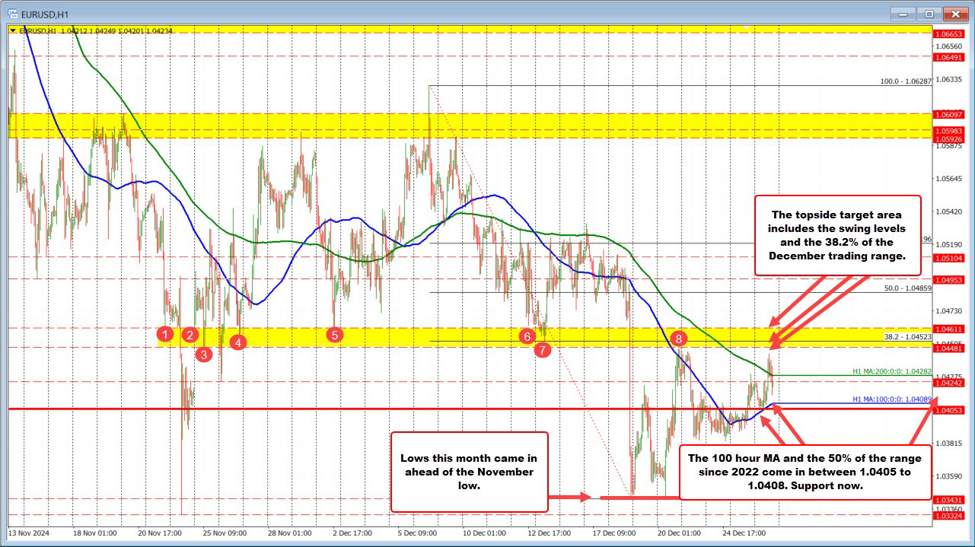

The EURUSD moved higher in the early European market and in doing so, extended above the falling 200-hour MA (green line currently at 1.04286). The high price reached 1.04433 which was short of the highs from earlier this week and the high from last Friday near 1.0448. Those highs stalled ahead of a swing area […]

Natural gas prices have been a recent winner and there is talk of longer-range forecasts showing a particularly-cold January in the northeastern United States. Today’s number is something of a disappointment though after last week’s 125 bcf draw. As for oil, it’s holding up today despite the ugly mood in markets and the EIA weekly […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

It’s a bit of a tricky one this time around with gold prices rising by over 27% already in 2024. Things have cooled off in November and December so far but that arguably owes much to the US election result, which in turn has also impacted the Fed outlook somewhat for next year. A surging […]

AltimaCRM by Intivion Technologies, one of the most innovative Forex CRM solutions on the market, will be attending the upcoming iFX EXPO Dubai 2025. Held on January 14-16 at the Dubai World Trade Centre, AltimaCRM will be showcasing its cutting-edge management tools to a global audience of brokers, prop firms, trading platform providers, and more. […]

At the end of the day, policymakers can and will spin the narrative to however they see fit with their decision. And with the BOJ these days, the leaked reports leading up to their meeting seem to be the more important part of the narrative. The latest inflation numbers from Japan’s capital here today might […]

At this stage last year, we were talking about how the Fed might cut rates by around six times in 2024. This time around, we’re talking about how they might not even get to two rate cuts in 2025. As thing stand, traders are pricing in just ~36 bps of rate cuts for next year […]