Domestic sight deposits CHF 436.4 bn vs CHF 448.0 bn prior This article was written by Justin Low at www.forexlive.com. Source link

Author Archives: gtiqy

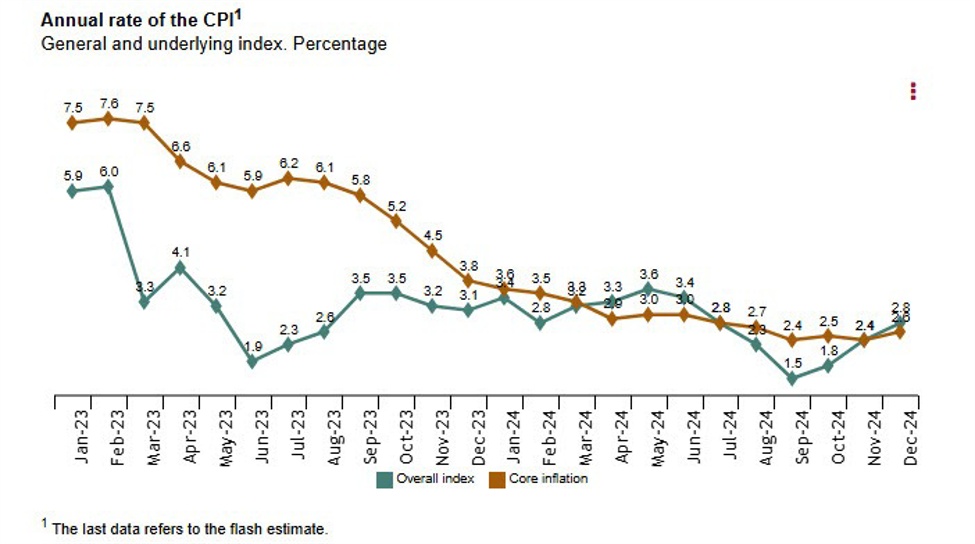

Prior +2.4% HICP +2.8% vs +2.6% y/y expected Prior +2.4% This article was written by Justin Low at www.forexlive.com. Source link

Adam had the news earlier: Former US President Jimmy Carter dies US President Biden has announced that Thursday 9 January 2025 will be the US National Day of Mourning for Carter: non-essential Federal workers are given the day off and stock and bond markets are closed Link to the full proclamation is above. This article […]

The People’s Bank of China (PBOC), China’s central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain range, called a “band,” around a central reference rate, […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

The EURUSD pair remains a focal point for traders and investors due to its volatility and importance in global markets. In this EURUSD technical analysis, we explore crucial support and resistance levels, as well as trends shaping the currency pair’s behavior in the near term. 📊🌍🔍 EURUSD 4hr chart with that strong support zone (so […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

Jibun Bank Final PMI from Japan for December is due today. Flash Manufacturing December: 49.4 (in contraction for 6 straight months.) November Final 49.2 Background to this is that Japan’s manufacturing sector experienced a consistent contraction over the previous three months, as indicated by the Jibun Bank / S&P Global Manufacturing Purchasing Managers’ Index (PMI): […]

SPX outlook: critical levels to watch for traders and investors The SPX price index is navigating a crucial technical landscape, with several key levels and indicators shaping its trajectory. A closer look reveals resistance at 6,200, support near the anchored VWAP, and the unclosed Trump Gap at 5,780, offering actionable insights for traders and in […]

Industrial profit Year to Date (YTD) -4.7% y/y For November alone a -7.3% y/y slump *** China’s industrial sector has experienced fluctuating profitability throughout 2024, influenced by various economic challenges and policy interventions, including but not limited to: insufficient effective demand declining industrial product prices (PPI deflation) October month alone 2024: Industrial profits fell by […]