Markets Summary The financial markets experienced a mixed day with significant moves across commodities, currencies, and equities. Here’s an overview: Commodities: WTI Crude Oil rose $0.81 (+1.09%) to settle at $74.18, supported by steady demand signals. Gold gained $13.76 (+0.52%) to close at $2,649.69, reflecting safe-haven buying amid market volatility. Silver edged up $0.08 (+0.29%) […]

Author Archives: gtiqy

Trump today again talked about the US taking over Greenland and also said he wouldn’t rule out force to do it. “This is a deal that must happen,” Trump earlier wrote on Truth Social. Last month he also said “ownership and control of Greenland is an absolute necessity”. The Danish PM said Greenland is ‘not […]

AI image Nomura expects the FOMC minutes from December to highlight divisions within the Committee on the rate cut decision and 2025 policy outlook, alongside detailed discussions on fiscal policy impacts, neutral rate assumptions, and inflation risks. Key Points: Conclusion: Nomura anticipates the December FOMC minutes will underscore internal divisions, fiscal policy considerations, and evolving […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

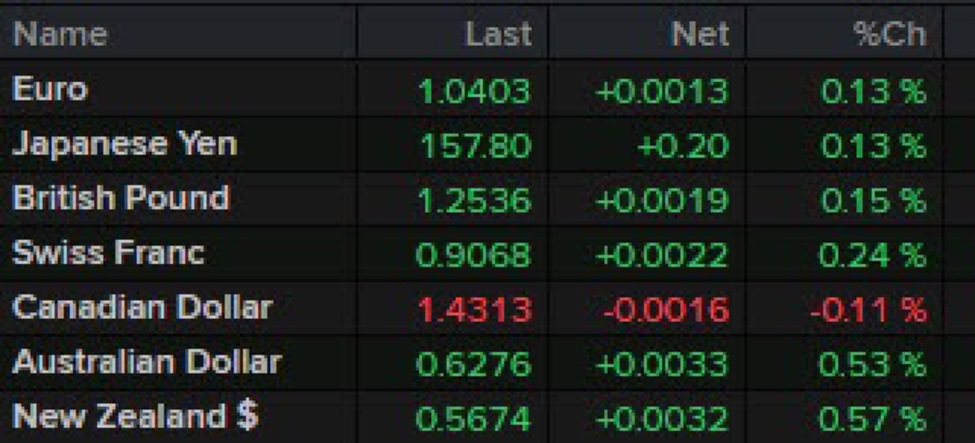

The USD is mixed today with the greenback lower vs the EUR, GBP, CAD, AUD and NZD and higher vs the JPY and CHF. The biggest movers are the AUD (USD -0.53%) and the NZD (USD -0.57%). Yesterday, the USD was mostly lower after the market reacted to a report that Trump tariffs would be […]

Tesla Stock Pre-Market Analysis Price at the Time of Analysis: $402.77 Key Levels to Watch for Tesla Bullish Above $416.50 Why Bullish Above?A move above $416.50 puts the price above the Value Area Highs of today (so far), yesterday, and two days ago. This clearly marks the top of the range, and a breakout above […]

Ethereum Futures Analysis for Today Financial Instrument: Ethereum FuturesPrice at the Time of Analysis: 3,690 Key Levels to Watch in ETH Futures Bullish Above 3,733 Why Bullish Above?A move above 3,733 signals that the price has surpassed yesterday’s Value Area High (VAH), a critical resistance level. This breakout could indicate buyer strength and open the […]

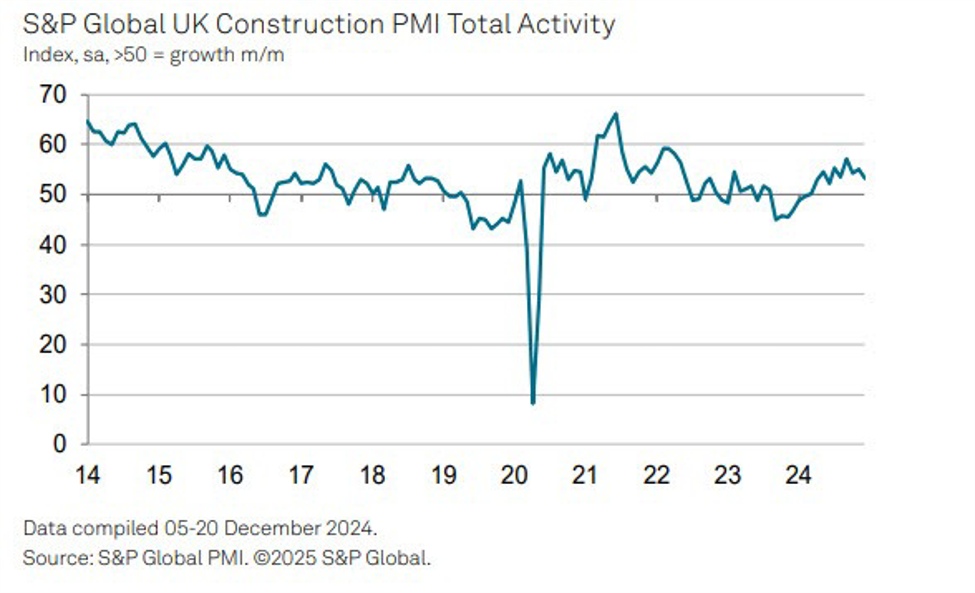

UK construction activity slows to six-month low as house building keeps a drag on the overall sector. Total new work was seen rising at its slowest pace since June but at least business optimism picked up after hitting a 13-month low in November. S&P Global notes that: “December data highlighted a loss of momentum for […]

Prior +1.3%; revised to +1.2% This article was written by Justin Low at www.forexlive.com. Source link

USD/JPY has dribbled off its session high after verbal intervention remarks. Japan’s Finance Minister Katsunobu Kato reiterated concerns about speculative yen selling as the currency hit 158.40 per dollar. This is not far from 160, a level that triggered intervention six months ago. Speaking at a press conference, Kato emphasized that the government is alarmed […]