Closing changes for the day: Stoxx 600 +0.4% German DAX flat France CAC +0.5% UK FTSE 100 +0.8% Spain IBEX +0.9% Italy’s FTSE MIB +0.6% It’s been a good week in Europe despite the turmoil in the US. This article was written by Adam Button at www.forexlive.com. Source link

Author Archives: gtiqy

Current outlook calls for gradual, patient approach to rate cuts. Supported December Fed rate cut but was a close call. Fed not on preset path, policy well-positioned. Current outlook in line with Fed December forecasts. Economy in a ‘good place overall’ with notable uncertainties. Too soon to say what impact election will have on economy. […]

Fundamental Overview The USD got a boost recently from another set of hot data as the US Job Openings surprised to the upside and the prices paid index in the ISM Services PMI jumped to the highest level since 2023. The market’s pricing didn’t change much though and Fed’s Waller yesterday kept the rate cuts […]

In the European session, the only highlight is the Eurozone Retail Sales data although it isn’t a market moving release in general. In the American session, we don’t have much on the agenda so the focus will be on the Fed officials with five of them scheduled to speak today. As a reminder, the stock […]

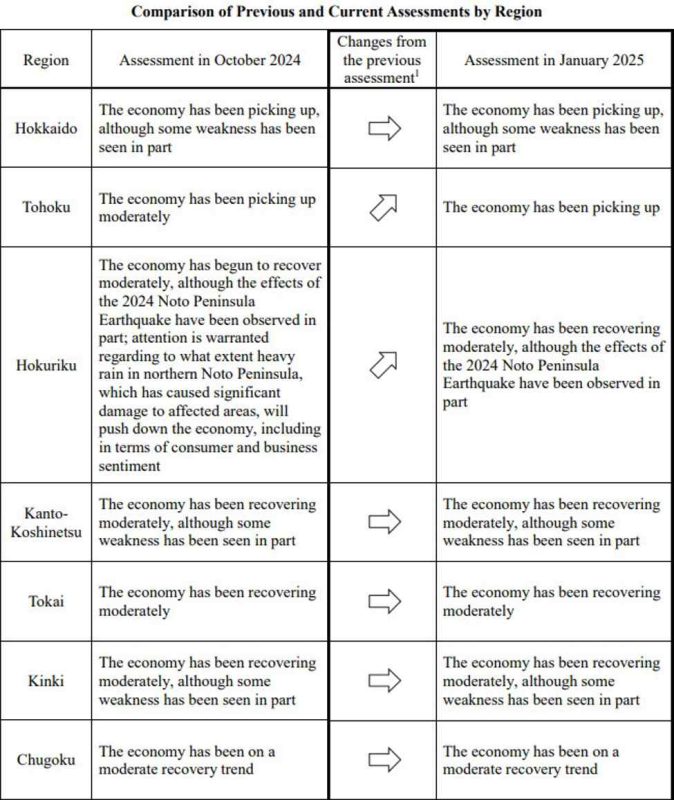

The regions that saw their assessment raised were Tohoku and Hokuriku. Meanwhile, the BOJ maintains the assessment for the other seven regions as seen above. This article was written by Justin Low at www.forexlive.com. Source link

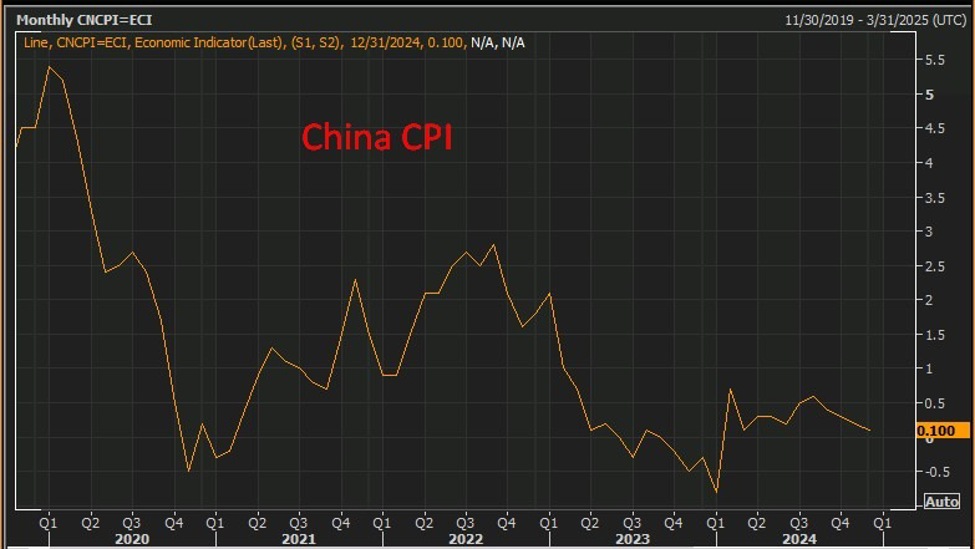

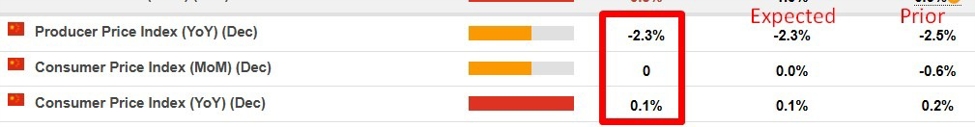

Data is here: China December CPI +0.1% y/y (expected +0.1%, prior +0.2%) Recap (summary of a Reuters report): Consumer Price Index: China’s CPI rose by 0.2% in 2024, matching the previous year’s growth and falling well below the 3% target. December CPI increased by 0.1% year-on-year, slowing from 0.2% in November and marking the weakest […]

Consumer and producer inflation data from China for December 2024 PPI remains in deflation and CPI barely avoids it. Pretty much as expected from China. The People’s Bank of China is wary of providing too much stimulus, such as a rate cut, due to financial stability and yuan weakness concerns. A political consideration now is […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

Adam Posen is an economist and President of the Peterson Institute for International Economics. He argues he expects the Fed to raise interest rates in the second half of 2025, unless the Trump Administration’s aggressive use of tariffs and deportations triggers a recession. However, it’s more likely that inflation will rise due to the combined […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]