Prior month revise to 109.45 from 109.55 Employment trends for December 109.70 This article was written by Greg Michalowski at www.forexlive.com. Source link

Author Archives: gtiqy

The order US stock indices are on a three day losing streak and on pace for its 4th today with the premarket futures trading to lower levels. A snapshot of the implied openings shows: Dow industrial average -75 points. S&P -45 points NASDAQ index -234 points Shares of Nvidia are trading down $5.18 or -3.81% […]

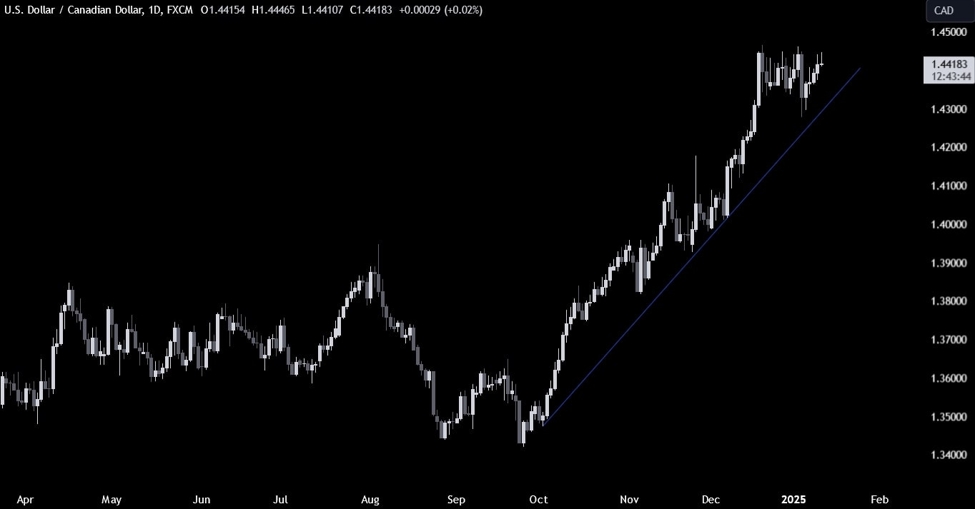

A day after the stronger than expected US jobs report, the USD is modestly higher with the largest gains vs the EUR (+0.52%) and the GBP (+0.81%). THe dollar has small gains vs the CHF, CAD, AUD and NZD and is lower vs the JPY (-0.22%) to start the week. EURUSD: THe EURUSD is stretching […]

The export restrictions mostly covers advanced computing chips used for AI and builds on previous curbs set out last year on exporting certain chips to China itself. The new controls on AI chips will see quotas on exports to about 120 countries but 18 US allies and partners will be exempt from that. The list […]

Fundamental Overview The USD got another boost on Friday following the NFP report as the data beat expectations by a big margin almost across the board. The market scaled back the rate cuts expectations further with now just one cut expected by the end of the year. The focus remains on inflation and this week […]

Rate cuts by year-end Fed: 24 bps (98% probability of no change at the upcoming meeting) ECB: 85 bps (90% probability of rate cut at the upcoming meeting) BoE: 42 bps (66% probability of rate cut at the upcoming meeting) BoC: 41 bps (57% probability of rate cut at the upcoming meeting) RBA: 61 bps […]

ECB unlikely to accelerate rate cuts. Cutting faster would need a more significant departure from out projections. Gradual moves are best amid uncertainty. Near-term market bets are justified. This article was written by Giuseppe Dellamotta at www.forexlive.com. Source link

Over the weekend, he adds that “the preparations are underway”. And that while “we haven’t set the exact framework for it yet”, the call is a starting point and they will take on discussions from there. As for the nature of the call itself, Waltz merely mentioned that: “You can’t enter a deal if you […]

Prior to the strong US jobs report at the end of last week, traders had priced in the first rate cut for June this year. In total, market players were looking for ~42 bps going into Friday at the time. Fast forward to today and the landscape has shifted quite dramatically. As things stand, Fed […]

Its been a notable session of new highs and lows. I’ve been tweeting them as they happened rather than posting them, but here they are for the record: GBP/USD hits a 14 month low under 1.2193 (GBPeso?) … and its since dropped lower AUD/USD falls under 0.6140 and to its lowest since April 2020 (ps. […]