The Bank of Canada has signalled it will ‘proceed carefully’ on further rate cuts but that was before the big US ‘Liberation Day’ risks to global growth and the recent drop in oil prices. The swift re-ordering has left the market off-balance about what the Bank of Canada might do at Wednesday’s meeting. At the […]

Author Archives: gtiqy

Amazon has reached out to its third-party sellers to better understand how the recent U.S. tariffs—particularly those targeting Chinese imports—are affecting their operations. Over 60% of Amazon’s sales come from third-party sellers, many of whom source products from China. The move signals Amazon’s concern over potential supply disruptions and pricing shifts ahead of peak retail […]

USDCAD technicals The USDCAD is attempting to stage a recovery after posting a new low yesterday at 1.38278—the lowest level since November 2024. The bounce higher has taken the pair back up to test the 100-hour moving average, currently at 1.3952. This level represents the first major technical hurdle for buyers. A sustained move above […]

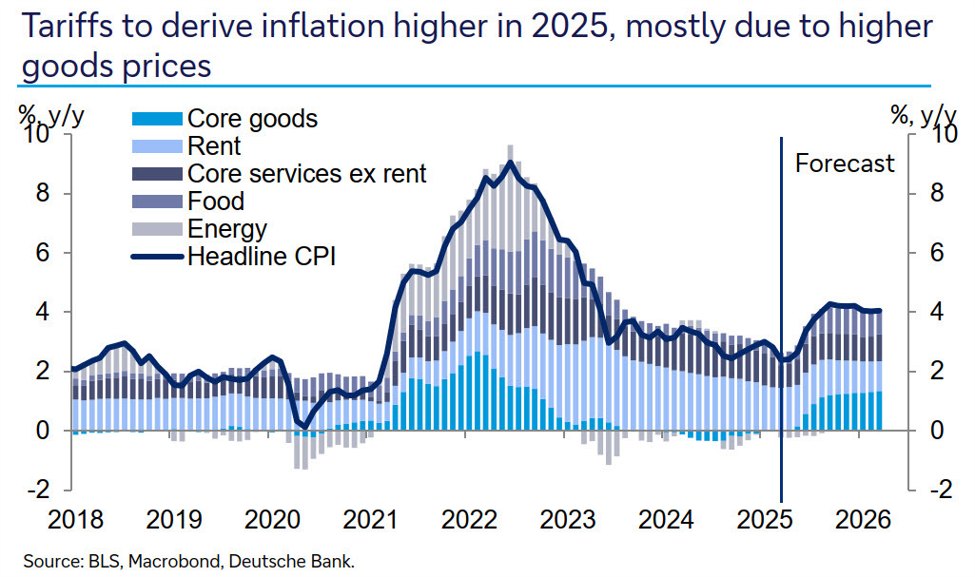

The world is facing a dollar confidence crisis as the repercussions of “Liberation Day” continue to reverberate, Deutsche Bank says. The German bank is out with its latest forecasts for the US economy and is increasingly tilting towards a stagflationary scenario. 2025 US growth forecast cut to 0.9% (q4/q4), hit by tariffs, policy uncertainty and […]

I spoke with BNNBloomberg yesterday about the weakness in the US dollar so far this year and what’s driving it. I highlighted six main points that I also wrote about yesterday. Tariff troubles sparking supply chain fears beyond simple inflation math, with markets nervous about potential cascading disruptions similar to COVID experience Growth agenda taking […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

The US stock market is little changed. The US yields are higher by about 3-4 basis points after falling by 10 or so basis points yesterday (last week yields did move sharply higher). For the US the dollar is mixed vs the major currencies – the EUR, JPY and GBP. For the EURUSD the price […]

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not […]

Learn Options 101: Your Introduction to Stock Options Education & Options Trading 101 Welcome to the first article in our comprehensive ‘Learn Options’ Series designed for beginners and experienced traders alike. This guide aims to demystify options trading, beginning with foundational concepts and straightforward examples to make this complex topic approachable for everyone. Brand Transition […]

Learn Investing: How Higher Prices and Stagflation Hit Bank Stocks Because when households feel squeezed, banks start feeling it too. How inflation and stagflation can hit the banking sector If you’ve been watching inflation stay stubbornly high, you might assume it’s mostly a consumer problem—groceries cost more, energy bills climb, and vacations get shelved. But […]